Preserving The Tip Credit

Preserving The Tip Credit

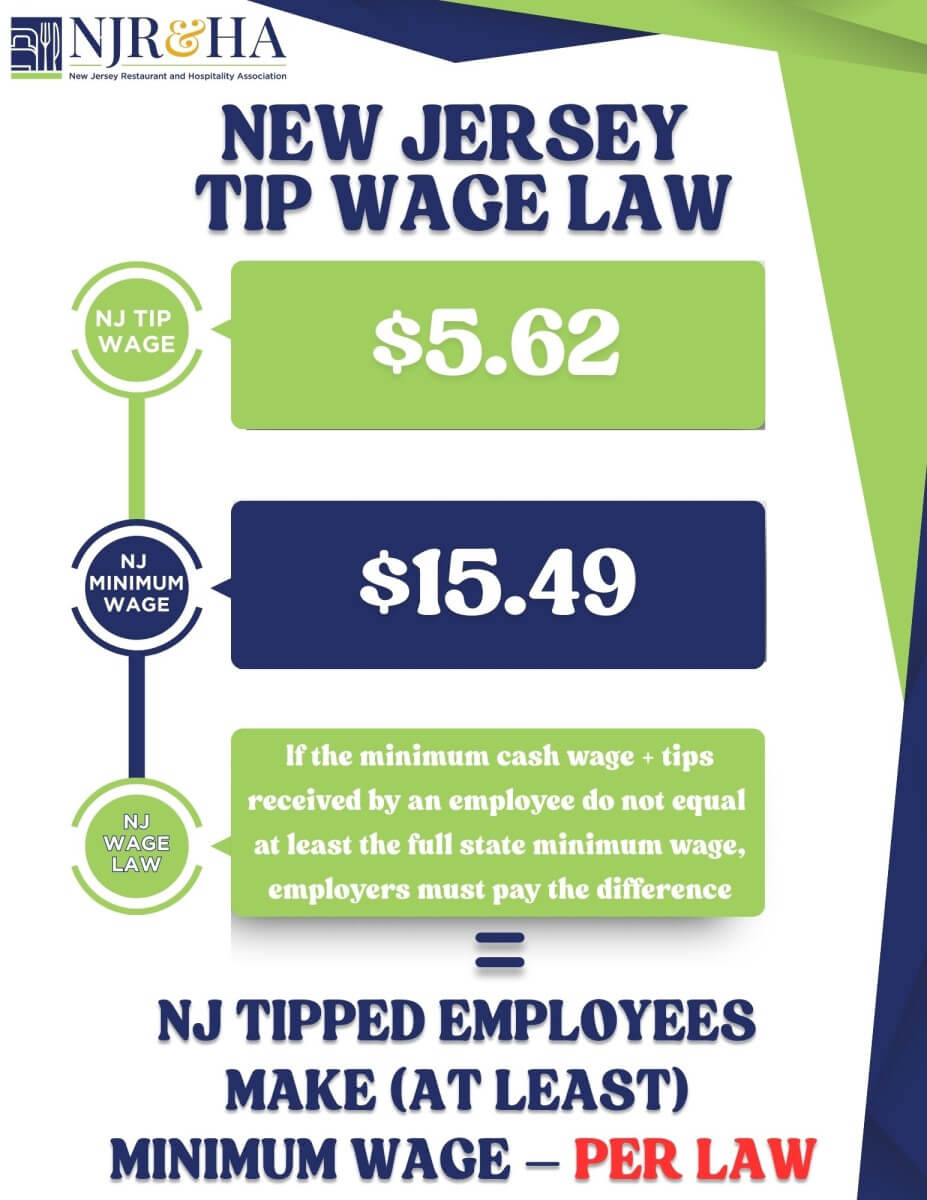

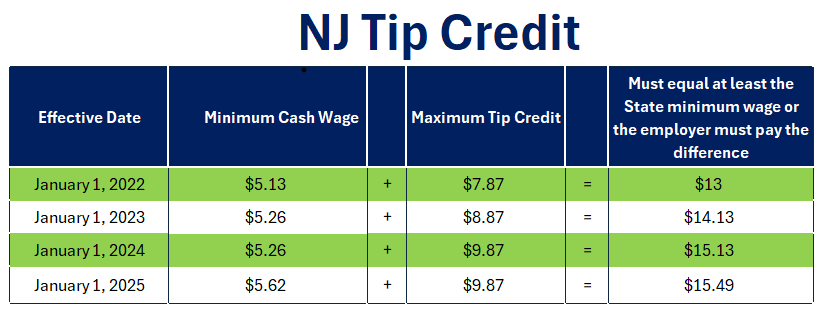

The tip credit is a cornerstone of New Jersey’s restaurant and hospitality industry, ensuring that tipped employees earn competitive wages while allowing businesses to manage labor costs effectively. This system supports a thriving industry by balancing fair compensation for workers with sustainable business operations.

Eliminating the tip credit would have serious consequences on the New Jersey hospitality

industry, including:

-

- Significant financial strain on businesses

- Higher operating costs

- Increased menu prices

- Fewer job opportunities

- Potential restaurant closures

Removing the tip credit would dismantle a system that allows tipped employees – who typically earn well above the minimum wage – to maximize their income while benefiting from the flexibility the hospitality industry provides. This change would directly impact thousands of workers, reducing earning potential and limiting job opportunities statewide.

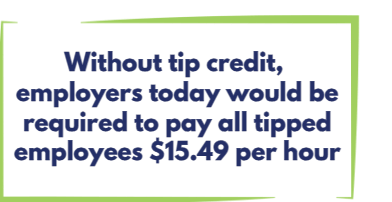

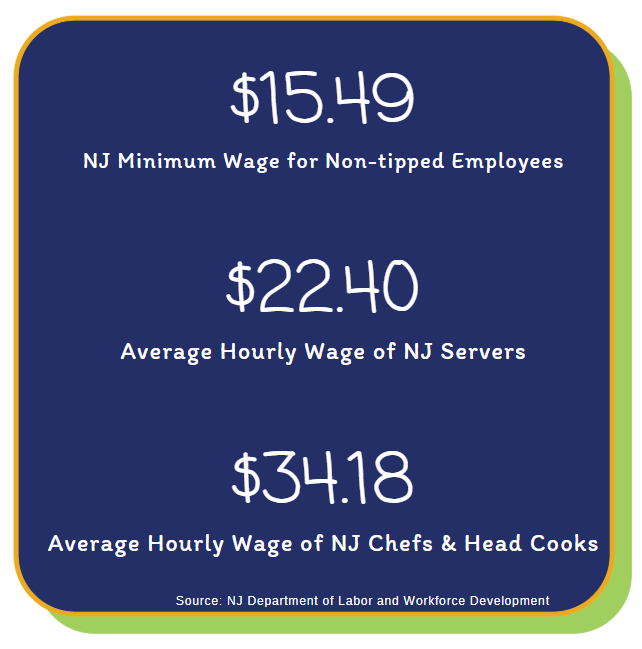

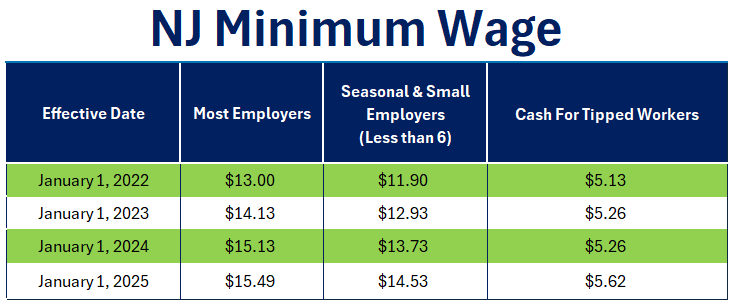

In New Jersey, servers make on average $22.40 per hour while chefs and head cooks make on average $34.18 per hour – well above the State's $15.49 minimum wage, according to the New Jersey Department of Labor and Workforce Development. If the minimum cash wage plus the tips received by an employee do not equal at least the full state minimum hourly wage, then the employer must pay the employee the difference.

The tip credit model enables restaurants to deliver quality service, maintain affordable pricing, and sustain vital job opportunities across the state.

Preserving the tip credit is essential to ensuring a strong, stable future for New Jersey’s hospitality industry.

The New Jersey Restaurant & Hospitality Association is committed to advocating for policies that protect both employees and businesses.

If you have any questions regarding tip credit or any other legislative matters, e-mail Vice President of Public Affairs, Amanda Stone, at astone@njrha.org today!

2025 TIP CREDIT & MINIMUM WAGE

- Wage and Hour Compliance

- Earned Sick Leave

- Employer Poster Packet

- Tipped Worker Protections

- Know Your NJ Work Rights: English, Spanish